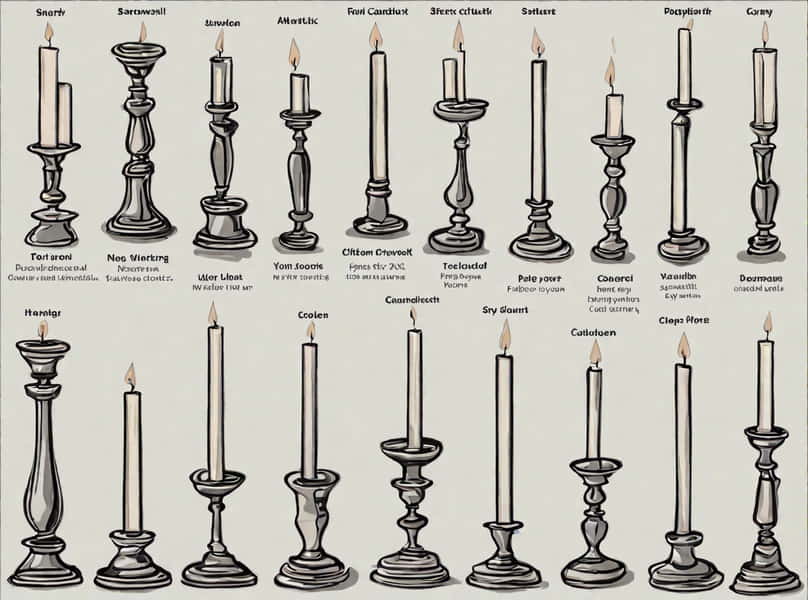

Welcome to the ultimate guide on mastering the art of trading through the Candlestick Patterns Cheat Sheet. Whether you’re a seasoned investor or a beginner navigating the financial markets, understanding candlestick patterns is crucial for making informed decisions. In this comprehensive guide, we’ll unravel the mysteries of candlestick patterns, providing you with insights, tips, and real-world experiences to enhance your trading skills.

Candlestick Patterns Demystified

Candlestick Patterns Cheat Sheet: A Roadmap to Successful Trading

Embark on your trading journey armed with our Candlestick Patterns Cheat Sheet, a comprehensive roadmap designed to decipher market movements. From basic patterns to advanced strategies, this cheat sheet covers it all. Let’s delve into the fascinating world of candlestick patterns.

The Basics of Candlestick Patterns

Grasping the Essentials

Understanding the basic candlestick patterns lays the foundation for successful trading. From Doji to Hammer, each pattern conveys valuable information about market sentiment. Explore these fundamental patterns to enhance your analytical skills.

Advanced Candlestick Patterns

Elevate Your Trading Game

Go beyond the basics and explore advanced candlestick patterns like the Bullish Engulfing and Bearish Harami. Uncover the nuances of these patterns to gain a deeper understanding of market dynamics and refine your decision-making process.

Candlestick Patterns Cheat Sheet in Action

Real-Life Applications

Learn how to apply the Candlestick Patterns Cheat Sheet in real-world trading scenarios. Through practical examples and case studies, discover how successful traders leverage these patterns to predict market trends and make strategic moves.

FAQs (Frequently Asked Questions)

What is the significance of the Candlestick Patterns Cheat Sheet?

Unlocking the potential of the Candlestick Patterns Cheat Sheet is crucial for traders. It serves as a visual guide, helping identify trend reversals and market sentiment.

How often should I refer to the Cheat Sheet while trading?

Frequent reference to the Candlestick Patterns Cheat Sheet is recommended, especially for beginners. As you gain experience, you’ll develop an intuitive sense for market patterns.

Are there specific patterns more relevant for long-term investors?

While short-term traders often focus on quick gains, long-term investors can benefit from patterns like the Morning Star or Evening Star, indicating potential trend reversals.

Can I solely rely on candlestick patterns for trading decisions?

Candlestick patterns are a valuable tool, but combining them with other technical analysis methods enhances decision-making accuracy. Diversify your strategy for optimal results.

How does market volatility affect candlestick patterns?

High market volatility can amplify the significance of candlestick patterns. Traders should adapt their strategies based on current market conditions.

Is the Candlestick Patterns Cheat Sheet suitable for cryptocurrency trading?

Yes, the principles of candlestick patterns apply across various markets, including cryptocurrencies. Adapt your understanding to the specific nuances of the market you’re trading.

Conclusion

In conclusion, the Candlestick Patterns Cheat Sheet is a powerful ally for traders, providing a visual roadmap to navigate the complexities of the financial markets. Arm yourself with knowledge, practice diligently, and watch your trading skills reach new heights. Take charge of your financial destiny with the insights gained from this comprehensive guide.